In times of financial need, turning to a gold-backed loan offers a secure, efficient way to unlock cash without resorting to high-interest unsecured debt.

The Epos Gold Loan stands out for its fast processing, competitive 18.0% APR, and borrower-friendly terms that cater to individuals with urgent expenses or short-term funding goals.

With minimal paperwork, flexible repayment options, and added benefits for Epos Gold Card holders, it’s an accessible solution designed to make your gold assets work smarter, without giving them up.

Why Many Borrowers Choose Epos Gold Loan?

Securing a loan against gold unlocks reliable borrowing capacity at competitive costs, giving you a practical alternative to high-interest unsecured credit.

- Quick disbursal delivers cash soon after appraisal, so last-minute bills never derail plans.

- Competitive 18.0 % APR generally undercuts rates on typical credit cards worldwide.

- High loan-to-value ratios maximize borrowing power by advancing up to a large share of your gold’s market price.

- Minimal paperwork reduces admin time because identification and address proof usually suffice.

- Flexible repayment schemes let you match installments to pay cycles or clear the balance in one bullet payment.

Eligibility Checklist Before You Apply

Confirming eligibility in advance keeps the application journey smooth and prevents surprise rejections during appraisal.

- Applicants must be at least twenty years old.

- Japanese residency and a verifiable local address remain essential today.

- Stable income, whether salary or self-employment, supports repayment confidence.

- Government-issued identification such as passport or driver’s licence validates identity.

- Clean credit behaviour increases approval odds and can influence maximum credit limits.

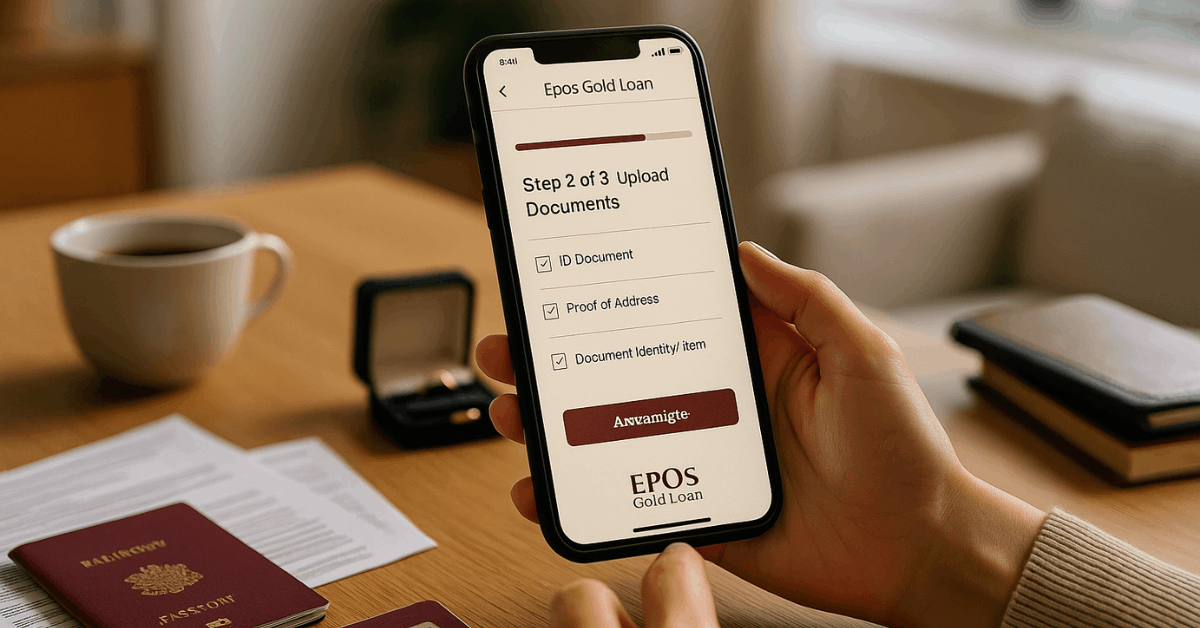

The Application

Following a structured sequence speeds completion and guarantees nothing is overlooked.

- Collect documents covering identity, address, and income to avoid repeat visits.

- Visit an Epos branch or log in online depending on convenience and distance.

- Submit jewellery for appraisal so specialists can record purity, weight, and spot value.

- Review and accept the loan offer once valuation and compliance checks pass.

- Receive funds by bank transfer or withdraw instantly at an Epos-compatible ATM.

Interest, Fees, and Total Cost

Annual interest remains fixed at 18.0 %, calculated daily on the outstanding balance. A small processing fee may apply, disclosed upfront.

Failing to meet due dates triggers late-payment charges, so scheduling reminders proves wise.

Early settlement incurs no prepayment penalty, letting you cut interest by clearing the balance sooner. Borrowing ¥10 000 for thirty days illustrates the formula:

- 10 000 × 0.18 ÷ 365 × 30 ≈ ¥147 interest.

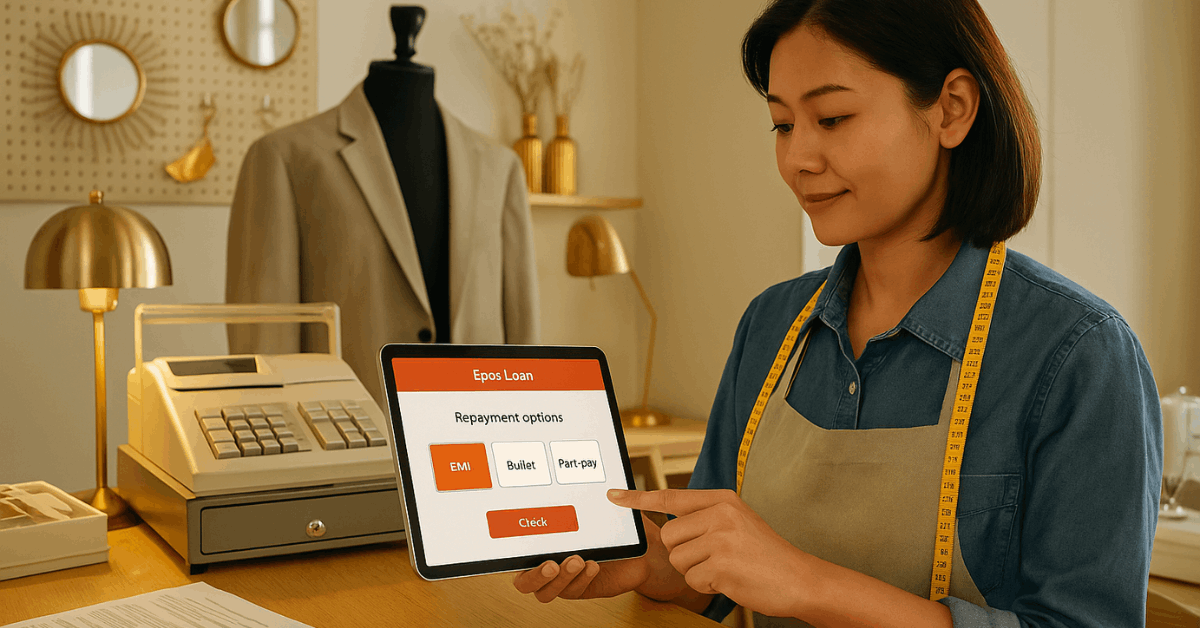

Repayment Playbook Built Around Flexibility

Selecting a repayment route that matches earnings habits prevents undue strain on monthly budgets.

- Equated Monthly Instalments (EMIs) combine principal and interest in predictable amounts, aiding strict budgeting.

- Bullet repayment leaves principal untouched until loan maturity, helpful when lump-sum inflows are expected.

- Part-payment reduces principal whenever extra cash appears, immediately lowering interest accrual.

- Loan renewal remains possible on maturity, subject to appraisal and policy, extending liquidity without fresh documentation.

Smart Uses for Borrowed Funds

Allocating loan proceeds to productive or urgent needs amplifies the value of each borrowed yen.

- Consolidate high-interest debts into one manageable obligation and cut monthly outgo.

- Expand a small business by purchasing inventory, upgrading equipment, or funding marketing.

- Finance education costs for professional credentials that raise earning power worldwide.

- Cover medical emergencies quickly, avoiding delays that risk health outcomes.

- Upgrade or repair a home to boost property value or living comfort.

Extra Perks That Stretch Every Yen

Borrowers holding an Epos Gold Card can capture additional savings and conveniences that extend well beyond loan proceeds.

- Points Discount Service lets everyday card spending earn points redeemable as statement discounts.

- Epos Easy Payment supports split payments for utilities or online shopping without forms.

- Seasonal bonus points accelerate rewards accrual during campaigns.

- Airport lounge access and travel insurance enhance worldwide journeys at no extra charge.

Security and Data Privacy Safeguards

When you use the Epos Gold Loan platform—whether through an online portal or an ATM—your data and transactions are protected using encrypted communication.

This means that the information you send or receive (like your login credentials or transaction details) is scrambled into a secure format that hackers can't easily read, even if they try to intercept it.

Two-factor authentication adds another gate against unauthorised logins. Regularly reviewing account statements and avoiding public Wi-Fi further shrink risk.

Responsible Borrowing Strategies

Adopting disciplined habits ensures the gold loan remains a helpful tool rather than a lingering burden.

- Borrow strictly according to genuine need, even when higher limits appear tempting.

- Use the Epos loan simulator before committing, confirming the interest cost fits projected budgets.

- Set automated payments whenever possible to eliminate late-fee worries.

- Reach out early to customer service if income unexpectedly drops; restructuring options may exist.

Alternatives When Gold Loans Are Unsuitable

Certain credit cards with instalment plans feature lower introductory rates for big purchases. Bank personal loans may deliver larger ticket sizes with extended terms, albeit after lengthier approval.

Peer-to-peer platforms connect borrowers and investors directly, sometimes offering rate flexibility. Comparing all costs and approval requirements worldwide prevents mismatched decisions.

FAQ Snapshot for Quick Clarity

Short answers resolve common doubts without lengthy calls or browsing.

- Can early repayment occur without penalty? Yes, reducing overall interest immediately.

- Is the online simulator free? Absolutely, and it remains open around the clock.

- How fast do funds arrive? Disbursement happens instantly once approval completes.

- Must applicants visit a branch? No, every step is available via mobile or web if preferred.

- Can borrowing resume after full repayment? Yes, provided available limit and good standing remain intact.

Support Channels and Operating Hours

Clear communication lines help you solve issues quickly and stay confident about account status.

- Tokyo Customer Centre: 03-3383-0101

- Osaka Customer Centre: 06-6630-0101

Online portals and smartphone apps remain available 24/7 for statements, repayment schedules, or limit reviews.

Conclusion

Turning dormant jewellery into capital through the Epos Gold Loan gives you powerful financial agility without parting from cherished assets.

Competitive pricing, minimal paperwork, and flexible repayment structures simplify cash management worldwide.

Always verify the latest conditions on the official website, then borrow smart, repay on time, and watch that gold work harder for you.