Securing extra funds should strengthen your budget, not derail it.

This guide breaks down every step in Lake’s loan application so you can move forward confidently and avoid costly surprises.

Clear knowledge of the process puts you in control and helps ensure smarter financial decisions.

Why Planning Your Loan Strategy Matters

Reliable preparation keeps repayment stress low and approval odds high. You will finish this section with a clear checklist that protects your income-to-expense balance worldwide.

Lake loans range from 10,000 yen to 5 million yen, yet limits mean little unless repayments fit comfortably within monthly cash flow. A deliberate strategy demonstrates to lenders that you can handle the commitment and safeguards your long-term financial stability.

Key Features That Set Lake Loans Apart

Borrowers gain practical advantages designed for flexibility and speed. Understanding these perks lets you decide whether the product genuinely serves your goals.

- A generous borrowing range allows you to request up to 5 million yen, providing worldwide applicants in Japan with the flexibility to cover medical expenses, renovations, or business growth without piecemeal funding.

- Variable annual interest of 4.5 %–18 % adjusts to credit strength, keeping costs competitive for firm profiles while still accepting modest scores.

- Two repayment models—balance-sliding revolving or fixed principal plus interest—offer control over how quickly the balance is paid down.

- Repayment windows of up to 10 years (120 installments) allow for lower monthly outlays when budgets are tight.

- Same-day disbursement arrives roughly 25 minutes after an online request is submitted before 9:00 p.m., avoiding the lengthy waits that traditional banks often impose.

- Interest-free intro periods of 60 days on borrowing up to 200,000 yen—and up to 180 days on a first-time loan below 50,000 yen—shrink early costs when cash flow is sensitive.

- No collateral or guarantor demands eliminate the risk of losing property if setbacks occur.

Eligibility Criteria You Must Meet

Meeting every baseline rule demonstrates reliability and prevents automatic rejection.

- Age band: Applicants between 20 and 70 years old qualify. Lending halts when you turn 71 during the active agreement.

- Stable income requirement accepts full-time employees, part-timers, and gig workers, provided earnings remain consistent.

- Residency and documentation: Proof of living status in Japan, plus valid identification, confirms legal capacity to borrow.

- Credit evaluation: Lake reviews prior repayment behavior and current liabilities to assign a tailored rate.

Satisfying these conditions positions your file for a smoother review.

Documents You Need on Hand

Lenders verify identity and capacity through paperwork. Collect all necessary items in advance to minimize processing time.

- Government photo ID, such as a driver’s license or passport—ensure expiry dates extend beyond the loan term.

- Income evidence—recent payslips, bank statements, or tax returns—proves cash flow stability.

- Supplementary income proof (if self-employed)—contracts, invoices, or audited statements strengthen credibility.

- Credit report—some applicants supply a recent bureau extract to resolve discrepancies quickly.

- Collateral certificate—only necessary when switching to secured products, not for standard Lake loans.

Digital copies must remain clear and complete; blurred images trigger follow-up requests that delay approval.

Interest Rates and Repayment Terms Explained

Clarity on cost structures shields you against unexpected debt expansion worldwide.

Annual Percentage Range

Lake sets interest rates between 4.5% and 18%, anchored to credit history, requested amount, and outstanding balance. Better scores unlock lower brackets, reducing lifetime charges.

Repayment Models

Minimum payment adjusts with the remaining principal, keeping installments manageable but extending total interest when only minimums are paid.

Each installment contains a consistent principal slice plus declining interest, promoting faster payoff and predictable schedules.

Illustrative Scenario

Borrowing 500,000 yen at 18 % annual interest on the balance-sliding plan yields:

- Installment: roughly 13,000 yen every 30 days.

- Total installments: 58.

- Overall repayment: 745,035 yen.

Opting for larger voluntary payments cuts both duration and interest burden.

Cost-of-Credit Formula

Total Cost = Principal + (Principal × Rate × Term).

A one-million-yen loan at 4.5 % over 36 months equals roughly 1,135,000 yen, assuming fixed rates and equal installments. Online calculators help test scenarios before signing.

Step-by-Step Guide to Submitting Your Application

Walking through the exact sequence averts omissions and accelerates approval.

1 – Check Your Credit Score

Higher scores unlock friendlier rates. Pull a free report, correct errors, and reduce revolving balances where possible.

2 – Select the Appropriate Loan Amount

Borrow only what your repayment capacity can sustain. Oversized requests invite rejections or excessive rates.

3 – Gather Every Required Document

Assemble identification, income proofs, and any supplemental files into clear PDF or image formats.

4 – Complete the Application

- Online route: Visit Lake’s portal, tap Apply Now, and enter personal, employment, and financial details.

- In-branch option: Head to Shinsei Financial’s offices for staff assistance; bring originals and copies of documents for immediate scanning.

- Phone support: Call 03-3525-9000 during business hours for assistance with fields or definitions.

Accuracy is decisive; mismatched numbers cause verification loops.

5 – Submit and Monitor Status

Lake typically returns a decision within 25 minutes for online files. Confirmation is sent via SMS or email, along with contract links for electronic signature.

6 – Review and Accept

Read rate, fee, and term disclosures carefully. Accept electronically or in person, then await disbursement to your nominated account.

Tips That Push Your Approval Odds Higher

You want to increase your chance of approval? Follow these tips:

- Maintain steady employment for several months before applying to present a clear income pattern.

- Limit concurrent credit inquiries within 30 days to prevent score dips.

- Allocate repayment funds in your budget calendar immediately after payday to avoid missed due dates.

- Opt for electronic statements to avoid misplacing paper notices.

- Set automatic transfers that meet or exceed the minimum to accelerate principal reduction.

Common Mistakes That Delay Funding

Avoid these pitfalls to keep processing swift.

- Supplying partial documentation that forces repeated uploads.

- Overstating income in hopes of bigger limits—verification exposes discrepancies.

- Ignoring the late-payment fee of 20 % annualized, which inflates costs rapidly after a missed due date.

- Borrowing beyond practical need increases both stress and interest.

- Skipping the interest-free window rules, thus missing an easy saving opportunity.

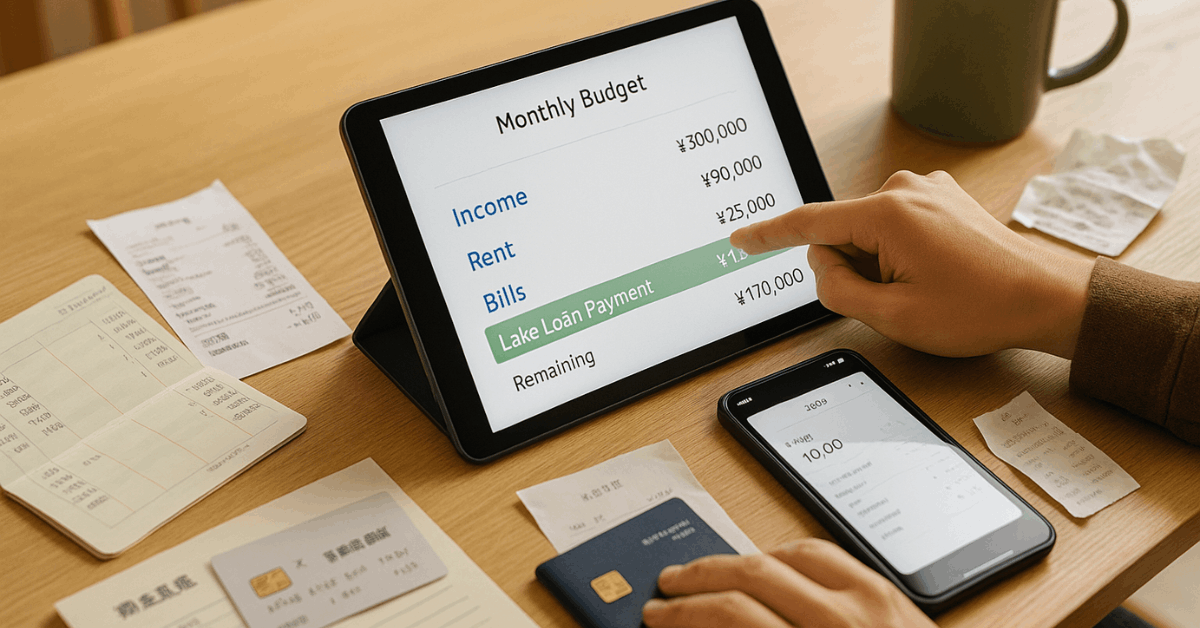

Balancing Repayments With Your Budget

Sustainable borrowing hinges on matching installment size to predictable cash flow worldwide.

Draft a spreadsheet forecasting monthly income, fixed obligations, and discretionary spending.

Insert the prospective Lake installment and confirm a comfortable surplus remains. Adjust the tenor or amount until this gap stays positive every month of the loan term.

Customer Support and Dispute Resolution

Questions rarely vanish on their own. Direct help prevents small uncertainties from growing into costly missteps.

- Telephone assistance: 03-3525-9000 (09:00–17:00, weekdays).

- Head office: 3-12-8 Sotokanda, Chiyoda-ku, Tokyo.

- Designated dispute body: Japan Finance Association—Finance Consultation and Dispute Resolution Center, 0570-051-051.

- Official website: lakealsa.com for real-time updates, calculators, and secure login.

Keep reference numbers handy when calling to accelerate service.

Conclusion

Lake loans provide rapid funding, flexible terms, and transparent pricing for applicants worldwide who meet Japan’s residency requirements.

Preparation remains the decisive factor—assemble documents early, verify credit health, select a realistic amount, and commit to a repayment schedule that honors your broader financial priorities.

Following the steps outlined above positions you for swift approval and stress-free repayment.