Buying a home in Japan can feel complex, especially when you must juggle foreign-resident rules, language hurdles, and rapidly shifting rates.

Mizuho Bank’s mortgage portfolio helps you push past those barriers by pairing flexible interest structures with clear digital tools and optional English support.

The sections below map out the process, eligibility, documents, and insider tips so you can approach lenders with confidence instead of guesswork.

Why Mizuho Bank Mortgage Loan Stands Out

Choosing Mizuho Bank places you with one of Japan’s largest financial institutions, giving you direct access to competitive rates, repayment windows reaching thirty-five years, and an online dashboard that tracks every yen of your balance.

You gain cost transparency, optional group life coverage, and seasonal bonus-payment scheduling, which are rare in many markets worldwide.

Core Advantages

A concise rundown keeps the headline perks in view while you weigh competing lenders.

- Flexible interest menu combining fixed, variable, step-up, or blended segments.

- Up to thirty-five years to repay, easing monthly outflows.

- Optional group credit life insurance clears the debt if you die or face severe disability.

- 24/7 loan simulator that shows real-time payment estimates.

- Early or partial payoff permitted with low exit fees.

- Bonus-month principal payments for Japan’s twice-yearly corporate bonuses.

- Mizuho Direct online banking for statement downloads and extra repayment scheduling.

Eligibility Criteria

Qualifying hinges on proof of stable income, clean credit, and lawful residency. Mizuho accepts applications from Japanese citizens and long-term foreign residents; you can even apply while your permanent resident paperwork is still under review.

Borrowers must reach twenty years of age before signing and finish repayment by eighty. Your taxable income must originate in Japan, and most approvals typically begin near a ¥2 million annual threshold. Credit bureaus should show no bankruptcies, severe arrears, or unresolved judgments.

The financed property must be located on Japanese soil, and your current address must also be within the country. If income alone falls short, pairing up with a spouse or family member as a co-borrower stretches the approval bandwidth.

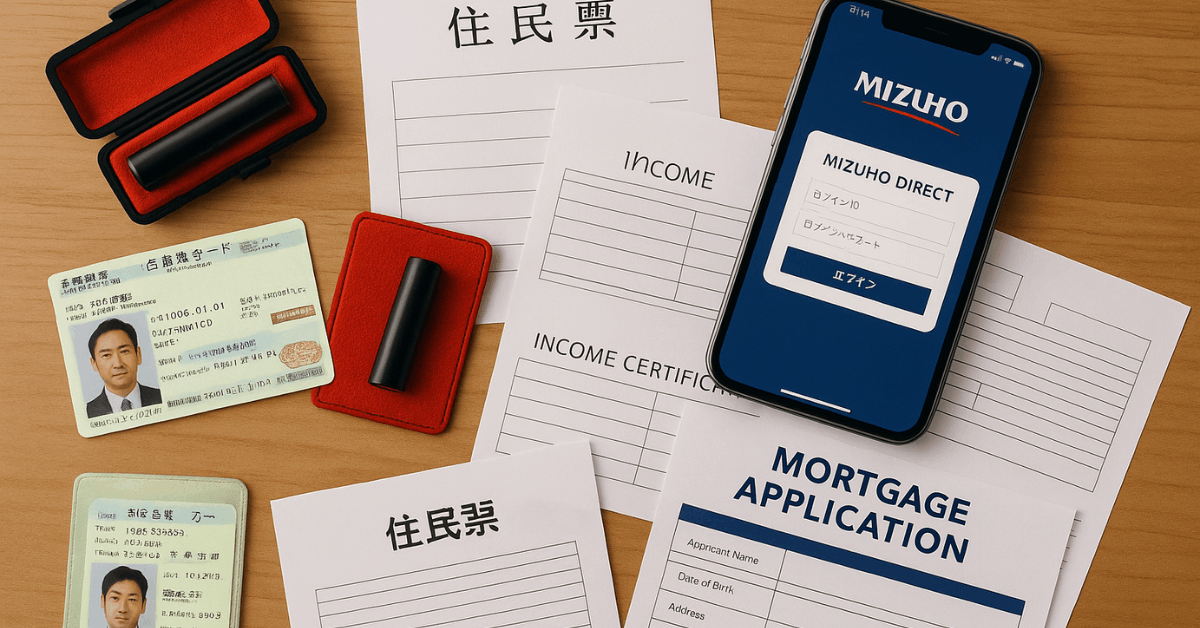

Document Preparation Checklist

A tidy file keeps loan officers on your side and shaves days off processing. Allocate a weekend to gather the following originals plus recent copies:

- Residence card proving legal stay and visa type.

- A passport for nationality and identity confirmation.

- Personal seal (inkan) and seal certificate, because Japanese contracts rely on physical seals rather than signatures.

- Income evidence such as the latest Gensen Choshu Hyo, recent payslips, or full self-employment tax returns.

- Residence certificate (Juminhyo) listing address and household members.

- Property purchase agreement outlining sale price and handover timeline.

- Certificate of registered matters (Tokibo Tohon) confirming ownership status and liens.

- Completed the Mizuho application form generated during your consultation.

- Domestic bank account details enabling automatic debits.

- Statements for existing loans so the bank can calculate debt-to-income ratios.

- Group credit life insurance form if you opt in for coverage.

Mortgage Product Options

Fixed-rate loans secure the same interest cost from day one until your final payment, making budgeting straightforward. Variable-rate loans float with market benchmarks, typically starting lower than fixed but carrying future-rate risk.

Step-up loans begin at a discounted rate for several years, then rise gradually; this design suits early-career professionals expecting consistent salary growth. Combination loans split principal into fixed and variable tranches, balancing predictability and potential savings.

Specialized refinancing products allow you to migrate an existing mortgage from another bank if Mizuho’s rates or insurance terms beat your current package. Renovation loans finance energy-efficient retrofits or structural upgrades without forcing a second lien on the property.

Rate and Fee Outlook (Early 2025 Snapshot)

Interest costs remain historically low, yet can change monthly. Always lock figures after your preliminary screening, not during casual research weeks earlier.

| Component | Typical level | Note |

| Fixed interest | ~3.5 % | Rate stays unchanged throughout term |

| Variable interest | ~0.6 % | Reviewed every six months or annually |

| Step-up starting rate | Below variable | Increases on a preset ladder |

| Processing fee | One-time | Covers application and paperwork |

| Appraisal fee | One-time | Pays external valuer |

| Early repayment fee | Low | Charged only when settling early |

| Group life premium | Optional | Scales with loan size and age |

Application: Eight Practical Steps

Having a roadmap turns an opaque approval pipeline into a series of predictable milestones.

- Run the online simulator to test loan sizes and monthly obligations.

- Book an appointment for an in-branch or video consultation to refine your plan.

- Submit all documents in one bundle to avoid piecemeal follow-ups.

- Await preliminary screening where staff verify identity and surface basic eligibility gaps.

- Undergo credit and property assessment, including bureau checks and professional valuation.

- Receive formal approval containing the interest plan, monthly payment, and insurance options.

- Sign contracts with your seal after reviewing every clause.

- Accept disbursement as funds move to the seller, builder, or current lender.

Pre-Approval Benefits

Securing pre-approval before launching a property search gives you a clear ceiling on price and signals seriousness to agents and sellers.

Most letters remain valid for roughly ninety days, enough time to shortlist, view, and negotiate. Speed at closing improves because the bank has already completed income and credit evaluations.

Flexible Repayment Feature

Mizuho recently debuted Japan’s first mainstream mortgage program that lets you shrink payments for up to twelve months when finances tighten, then boost them later.

Households facing maternity leave, temporary salary dips, or heavy education costs can tap the feature up to five times during the loan life, provided repayments have remained spotless and current income has not fallen below the figure declared at original approval.

Tips for Foreign Applicants

You face extra scrutiny not because of nationality but because lenders see shorter in-country credit histories and potential relocation risks. Position yourself for success by following these tactical moves:

Keep every domestic card and utility account current; even a minor late mark dents approval odds. Maintain taxed income inside Japan because most banks ignore offshore earnings.

Offer a larger down payment to lower loan-to-value ratios. Use branches with English-speaking staff to avoid translation errors. If language remains a hurdle, invest in lessons or lean on licensed bilingual real-estate agents who attend bank meetings with you.

Alternatives for Non-Permanent Residents

Several lenders court foreign buyers with headline rates that undercut many Western markets. Those institutions may trade low rates for stricter down-payment ratios or shorter rate-fix periods, yet they still widen your options.

| Bank | Variable rate (Sep 2024) | Non-PR acceptance | Key perk |

| au Jibun | 0.179 % | Yes | Lowest published rate nationwide |

| PayPay | 0.270 % | Yes | Fast digital application process |

| Ikeda Senshu | 0.320 % | Yes | Regional lender with flexible appraisal policy |

| Hyakujūyon | 0.700 % | Yes | Serves central Japan markets |

| Hokuyō | 0.970 % | Yes (non-resident) | Accepts overseas income proof |

| Jūroku | 1.050 % | Yes (non-resident) | Allows guarantor-free structures |

| Chūgoku | 1.200 % | Yes | Supports refinance from overseas banks |

| Jōyō | 1.380 % | Yes | Offers longer fixed-rate blocks |

Frequently Asked Questions

You might ask the following questions:

- Can foreigners obtain housing loans in Japan?

Yes. Approval hinges on residency length, income stability, credit health, and each bank’s exposure limits. - What is the maximum loan amount I can expect?

Banks often lend up to eight times annual income, but that figure shrinks if debt-to-income ratios exceed thirty-five percent. - Are there property-type restrictions?

Certain products exclude leasehold, very old structures, or dwellings branded as “jiko bukken” (sites of death or crime). - Do I need Japanese language fluency?

Some banks supply English contracts, yet most require Japanese during interviews. Bring a licensed bilingual representative if needed. - Can I shorten my repayment period later?

Yes. Extra principal payments or a refinance into a shorter term both reduce total interest expense. - Do lenders support LGBTQ couples?

Shinsei Bank leads with inclusive underwriting, and several major lenders, including Mizuho, have followed with gender-neutral documentation.

Conclusion

Owning property in Japan no longer belongs solely to citizens or permanent residents.

Mizuho Bank’s mortgage suite, paired with careful preparation and an organized document file, lets motivated buyers tap competitive rates and long repayment horizons while still benefiting from optional English support.

Start by running the online simulator, then set a consultation date. Move forward in clear steps, and soon you could hold the keys to a Japanese home without letting paperwork hurdles stop you.

Disclaimer

Interest rates, fees, and eligibility requirements are subject to change at any time. Always verify current terms directly with Mizuho Bank before applying.