Modern consumers appreciate services that eliminate paperwork, reduce waiting periods, and consolidate account management into a single interface.

Resona Credit Card delivers this convenience through an app-first workflow that handles everything from initial application to daily expenses in one secure place.

Corporate Background

The issuer behind every Resona Credit Card has operated since February 1983 and maintains capital of ¥1 billion.

President and CEO Haruhiko Suzuki leads the company, whose principal shareholders include Resona Holdings Co., Ltd. and Credit Saison Co., Ltd. Its Tokyo headquarters stand five minutes on foot from Kiba Station, while an Osaka branch sits two minutes from Sakaisuji Honmachi Station.

Both offices support a credit-card business, credit guarantees, gift-card sales, and related financial solutions.

Global Access Despite Local Offices

Although the head offices reside in Tokyo and Osaka, Resona Card products serve cardholders worldwide through Visa, Mastercard, and JCB networks.

This multinational reach means you can rely on the card while traveling or shopping online across borders.

Reasons to Choose the Resona Credit Card

Decide confidently using these proven advantages:

- Resona Group’s decades-long banking reputation reinforces customer trust through transparent policies and courteous service.

- Multiple international brands—Visa, Mastercard, and JCB—let you select the network matching your lifestyle and preferred acceptance footprint.

- Everyday spending earns points redeemable for partner programs, airline miles, gift cards, and catalog merchandise, creating tangible value for habitual card use.

- A fraud-detection system, two-step online authentication, and real-time alerts strengthen defense against unauthorized activity without complicating your routine.

- Contactless compatibility with Apple Pay, Google Pay, and tap-to-pay terminals speeds checkout and reduces surface contact in crowded environments.

- The Resona Group app combines card controls, domestic banking, and overseas remittances, eliminating separate logins for different tasks.

How to Download the Resona Card App

Head to the App Store or Google Play and search for “レソナカード アプリ.” Verify the official logo, then install the free download.

After launching, agree to the basic terms, link an existing Vpass ID, or create one in minutes. This initial setup unlocks secure, password-protected access ready for your application.

Step-by-Step Application Guide

Follow these clear actions to submit without delays

- Open the Resona Card app and select Apply for a Card on the home screen.

- Pick your preferred product, such as CLUB POINT PLUS JCB or a Disney-themed design aligned with personal taste.

- Enter personal data—full name, worldwide mailing address, verified email, and mobile number capable of receiving SMS codes.

- Provide employment details and annual income to support the credit screening.

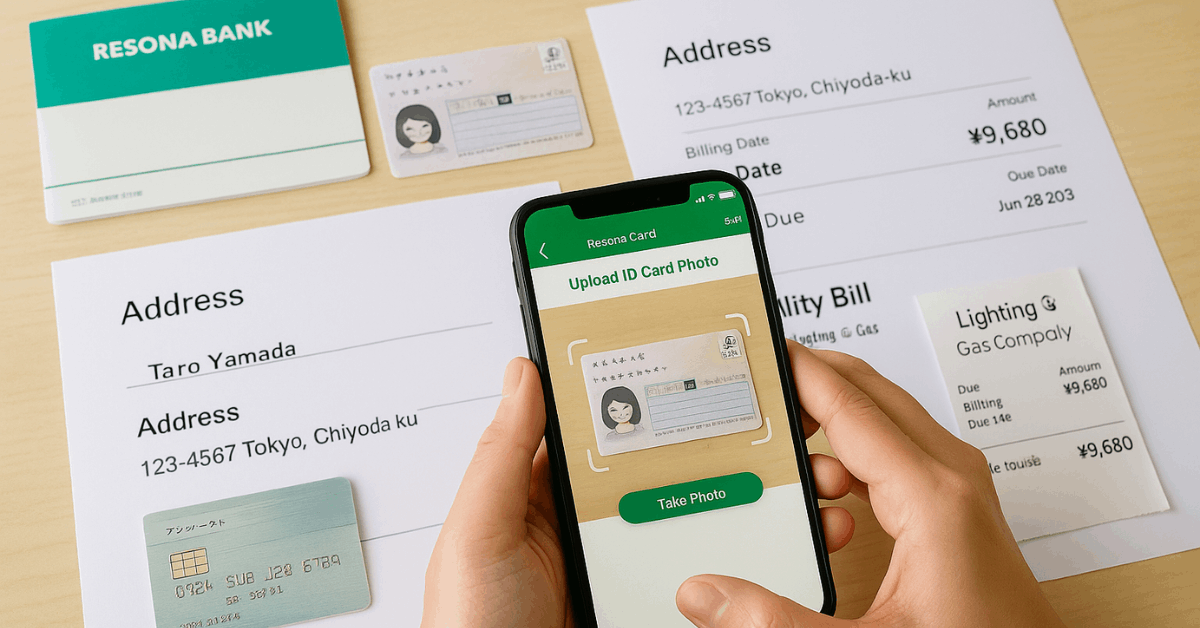

- Use the built-in camera function to photograph identification documents under bright lighting for optimal clarity.

- Review every field carefully, ensuring numbers, dates, and spellings match official records.

- Submit the application and monitor progress within the app dashboard while the issuer performs credit evaluation.

- Keep the registered phone nearby in case additional verification steps require immediate response.

Key Features and Benefits

Maximize everyday value after approval

- New cardholders may receive up to 3,000 bonus points when the first qualifying purchase posts promptly after account opening.

- Each yen spent earns reward points convertible into ANA miles, Rakuten R Points, digital coupons, or catalog products.

- Contactless technology eliminates magnetic-stripe swiping, cutting checkout times and reducing physical wear on the card.

- The Resona Card app displays live point totals and sends reminders when limited-time campaigns increase earning potential.

- CLUB POINT PLUS partner merchants provide extra multipliers, helping heavy shoppers accelerate rewards without extra fees.

Interest Rates and Fees

Standard purchases currently incur an annual rate of 15.0%, while cash advances attract an annual rate of 18.0%.

Annual fees vary by product; several entry-level cards remain free, whereas premium versions begin at ¥1,375 each year. Late payments trigger penalty interest, so on-time settlement protects your score and reduces expense.

Terms may change, so please consult the latest schedule within the app before making large transactions.

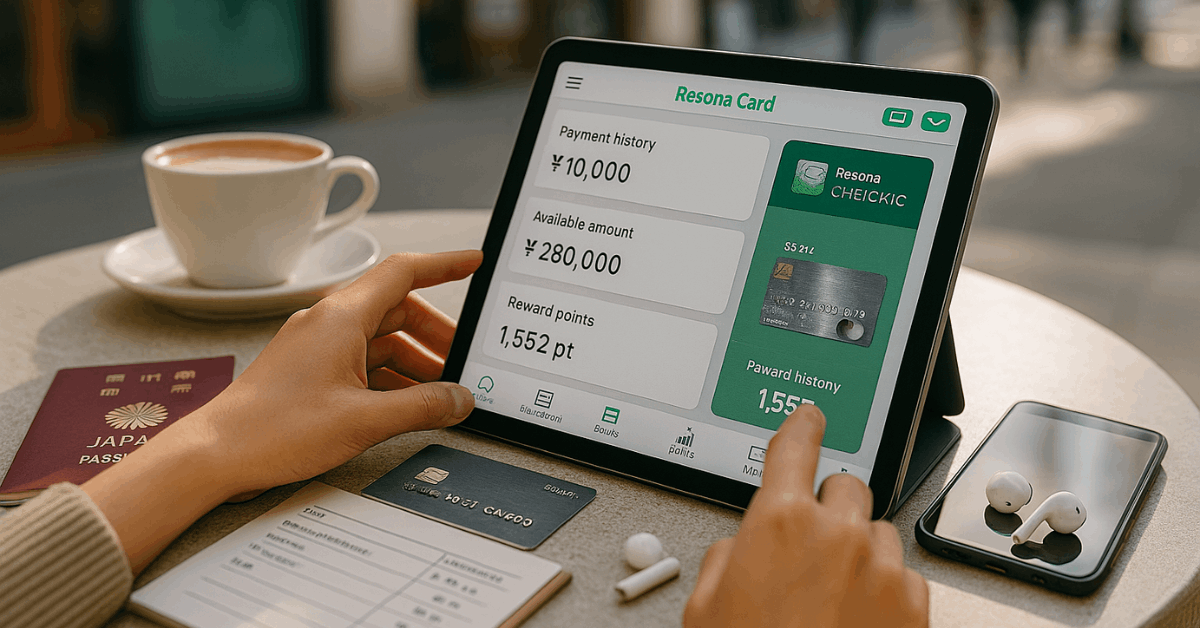

Managing Your Card Through Mobile

Two dashboard taps reveal payment history, upcoming due dates, and available credit. Users can activate Later Revo to postpone specific purchases when cash flow is tight, then return to regular installments afterward.

The World Present menu lists point balances alongside redemption shortcuts. Address changes, card locking, and spending alerts are all easily accessible under identifiable icons, ensuring you maintain control regardless of your location.

Redeeming Points for Rewards

Access the reward portal directly from the app home screen, where categories clearly display required points alongside expiration dates. Current options include airline mileage programs, Rakuten R Points, electronics, home goods, and gift cards.

Frequent seasonal campaigns raise promotional exchange rates, making periodic checks worthwhile for maximizing value. Always finalize redemptions before campaign deadlines to avoid forfeiting enhanced offers.

Tips for a Smooth Application

Reduce errors that commonly stall approval decisions

- Capture identification images on a stable surface under neutral lighting for sharp results.

- Enter your residential address exactly as printed on official documents, including apartment numbers and postal codes.

- Provide a mobile number capable of consistent signal reception, ensuring verification codes arrive promptly.

- Complete every mandatory field; leaving blanks often triggers manual review and prolongs processing.

- Proofread details for spelling accuracy and consistent use of romanization when required.

Security and Privacy Protections

Two-step authentication combines password entry with a secondary one-time code, while optional fingerprint or facial recognition speeds secure logins.

All transmitted data passes through encryption protocols, and backend servers reside in controlled environments.

Instant push notifications flag unusual spending so you can freeze the card directly from the app until support clarifies activity.

Additional Banking Services via the Resona Group App

The broader Resona Group App, available in English, Japanese, and simplified Chinese, allows users to open savings accounts, schedule domestic transfers, and send remittances to twenty countries, including the United States, Canada, Germany, and the Philippines.

Foreign-currency accounts in U.S. dollars, euros, Australian dollars, or New Zealand dollars are activated in approximately five minutes, and overseas remittances incur a transparent fee of ¥2,000, plus an additional ¥2,500 for yen transfers.

Award-winning interface design by TeamLab earned multiple industry accolades, reflecting clear layouts and intuitive one-tap commands.

Support and Contact Channels

Business-hour hotlines operate Monday through Friday, 9:00–17:00 Japan Standard Time, yet worldwide callers may prefer the in-app FAQ and chatbot available around the clock.

Detailed forms, policy updates, and branch addresses reside on the official website, making it easy to locate regional information without language barriers.

Conclusion

Applying for a Resona Credit Card through the mobile app removes paperwork, shortens approval times, and unifies card management with daily banking functions.

You control applications, payments, and reward redemptions from any connected device, backed by Resona Group reliability and internationally accepted networks.

Meeting income and age requirements remains necessary, and the issuer retains final approval authority, yet the streamlined process positions qualified applicants for swift access to modern financial tools.