The Sumitomo Mitsui Classic Loan offers a fast and straightforward way to access the funds you need.

With a straightforward application process and competitive rates, it’s designed to make borrowing hassle-free.

This guide will walk you through the steps to apply and get approved quickly so you can focus on what matters most.

What’s the Sumitomo Mitsui Classic Loan?

The Sumitomo Mitsui Classic Loan is a flexible and accessible financial option that easily allows you to borrow.

Whether you need funds for personal expenses, buying a car, or handling unexpected emergencies, this loan can help.

Backed by Sumitomo Mitsui's reliability and trust, it offers a simple, hassle-free way to secure the money you need.

Key Features and Benefits

This loan has various features and benefits to make borrowing easier and more manageable. Here’s a look at what you can expect:

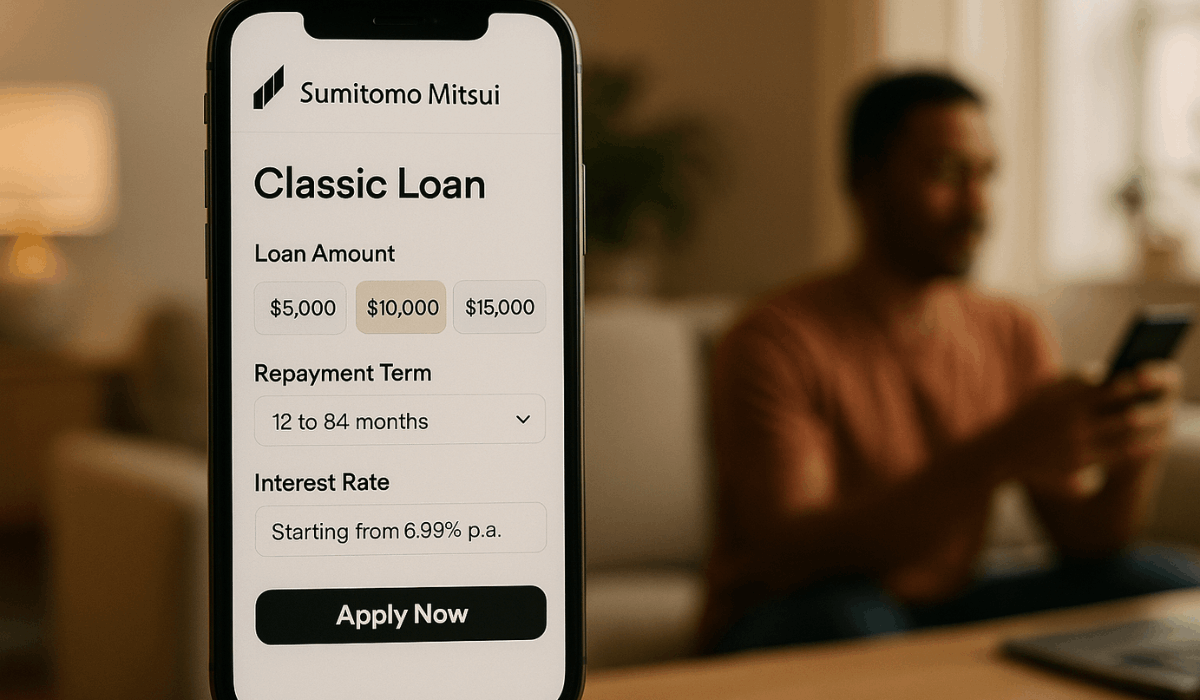

- Flexible Loan Amounts: Borrow the amount that best suits your needs.

- Customizable Repayment Terms: Choose from different repayment plans that fit your budget.

- Competitive Interest Rates: Enjoy lower rates compared to other financial products.

- Quick Approval Process: Get your loan approved and processed promptly.

- Online Application: Apply conveniently from the comfort of your home.

- No Collateral Required: Access funds without needing to provide assets as security.

- Reliable Customer Support: Assistance is available whenever you need help during the application process.

Who Can Apply? (The Basics of Eligibility)

Before applying for the Sumitomo Mitsui Classic Loan, check if you meet the eligibility criteria. Here's who can apply:

- Age: Applicants must be between 20 and 65 years old.

- Residency: You must be a legal resident of Japan.

- Income: Steady income or employment is required to prove your ability to repay.

- Credit History: A good credit history is generally preferred, though it may vary depending on the loan type.

How to Apply: Your Step-by-Step Guide

Applying for this loan is simple. Just follow these easy steps to get started:

- Step 1: Visit the official Sumitomo Mitsui website or download the mobile app to begin your application.

- Step 2: Choose the loan type that best suits your needs, whether for personal expenses, a car purchase, or an emergency.

- Step 3: Complete the online application form with your details, ensuring all required fields are filled accurately.

- Step 4: Submit necessary documents, such as proof of identity and income, to verify your eligibility.

- Step 5: Wait for approval as your application is reviewed, typically with a quick turnaround time.

- Step 6: Once approved, your funds will be disbursed directly to your bank account and ready for use.

Breaking Down the Numbers: Rates and Fees

Before proceeding, it's important to understand the costs associated with the Sumitomo Mitsui Classic Loan.

Here’s a breakdown of the interest rates and fees:

Interest Rates:

- Floating Rate Loan (1-year renewal): Rates are based on the bank’s base rate, reviewed monthly, and may vary at the time of agreement.

- Fixed Rate Loan (3, 5, 7, or 10 years): Fixed rates for the chosen term, set at the agreement and may change with market conditions.

Fees:

Administrative Fees

- A Plan (Interest Rate Focused): 2.2% of the total loan amount (including tax).

- B Plan (Initial Cost Focused): 22,000 yen (including tax).

Early Repayment Fees

- Partial Early Repayment (via phone): Free of charge (for reduced period type only).

- Partial Early Repayment (at branches or by mail): 5,500 yen (including tax) per request.

- Full Early Repayment (at branches or by mail): 44,000 yen (including tax).

Other Fees:

- Switching from Floating Rate to Fixed Rate Loan: 5,500 yen (including tax) per request.

- Fixed Rate Reselection: 5,500 yen (including tax) per request.

Repayment Options and Flexibility

When taking out a loan, it's essential to understand your repayment options to ensure that the terms align with your financial situation.

Here are the available repayment options and flexibility:

- Monthly Installments: Standard monthly repayments with flexible amounts depending on the loan type.

- Early Repayment: Option to pay off the loan earlier than the agreed term without penalties in some cases.

- Grace Period: Potential for a grace period if you cannot make the payment on time (subject to approval).

- Flexible Terms: Adjust repayment periods based on your income or financial needs.

- Repayment Extension: You can extend the repayment term with prior approval.

Loan Security and Collateral

When applying for a loan, knowing whether the loan requires collateral or is unsecured is essential. Here's a breakdown of loan security and collateral:

- Unsecured Loan: No collateral is needed, making the process quicker and more straightforward, but often with slightly higher interest rates.

- Secured Loan: Requires collateral (e.g., property or assets) to back the loan, which may result in lower interest rates.

- Collateral Requirements: Specific types of assets may be required as collateral for secured loans.

- Risk of Default: If you fail to repay a secured loan, the lender may seize the collateral to recover the loan amount.

- No Collateral for Small Amounts: Smaller loan amounts may not require security, depending on the lender's criteria.

Why Go for Sumitomo Mitsui Classic Loan?

This loan option offers several key benefits, making it an attractive choice for borrowers. Here’s why it could be the right fit for you:

- Quick and Simple Application: The process is fast and easy, requiring minimal paperwork.

- Competitive Interest Rates: Enjoy affordable rates that make borrowing cost-effective.

- Flexible Terms: Choose from various repayment options to fit your financial situation.

- Reliable Support: Backed by a well-established institution with excellent customer service.

- No Hidden Fees: Transparency in rates and fees ensures you won’t face unexpected charges.

Need Help? Here’s How to Get In Touch

Getting in touch is easy if you need assistance during the loan application process or have any questions. Here’s how you can reach out for support:

- Phone (Within Japan): 0120-373-706 (toll-free) or 03-6854-4500 (charges apply), available 9:00 AM – 5:00 PM, Monday to Friday (excluding holidays).

- Phone (From Overseas): +81-3-6854-4500 (charges apply)

- Service hours: 9:00 AM – 5:00 PM, Monday to Friday (excluding holidays)

- Email: For inquiries about asset management, inheritance, wills, home loans, etc., please contact the Bank or a branch that handles the transaction.

- Website: Visit the official website for more information and resources.

Wrapping Up: Your Loan, Your Way

The Sumitomo Mitsui Classic Loan offers a flexible, straightforward solution to meet your financial needs.

With competitive rates, an easy application, and reliable customer support, it’s a great choice for those who want to borrow with confidence.

Apply today and take the first step toward securing the funds you need!

Disclaimer

Loan approval is subject to the bank's review of your eligibility and financial status.

Please ensure you meet all requirements and carefully read the terms and conditions before applying.